PHOENIX, ARIZONA

I first spent time in Phoenix studying the market in 2010. The single family market has become increasingly competitive

since that time as prices started increasing in 2011 and lower-priced

inventory dwindled. The single-family median price

was down to

$109 574 in 2011, but hit $146 000 within a year and then $175 000 in

2013. This past May, 2014, the

most recent information I have, it had reached $192 000.

The market has turned a little during the last 4-5 months, with sales slowing and more inventory becoming available. Part

of the reason for this is the exit of hedge funds and other bulk buyers

of distressed property from the market. This is good

news for investors, since sellers may be willing to accept less profit

to move their property and consider offers that meet

your cash flow expectations.

The Phoenix economy has recovered much better than expected.

Reliant on construction and the housing industry in the past,

the city is currently showing robust job creation, increasing

employment diversity, and continued strong population in-migration.

I believe that Phoenix is a good choice for long-term cashflow and

appreciation, as long as you strategically choose your location.

I recently spent three months in Phoenix from January to April 2014 studying the city and researching the various neighborhoods.

Phoenix has surprisingly high crime rates in many areas as well as many low-income neighborhoods. Growth and development

are focussed in specific areas and corridors. I studied large

areas of Phoenix and now know most of the city. If I do not know

an area, I will not offer wholesale property to my investors.

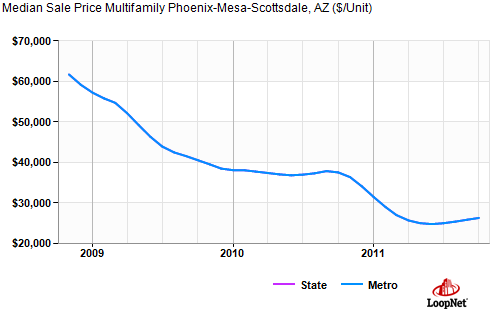

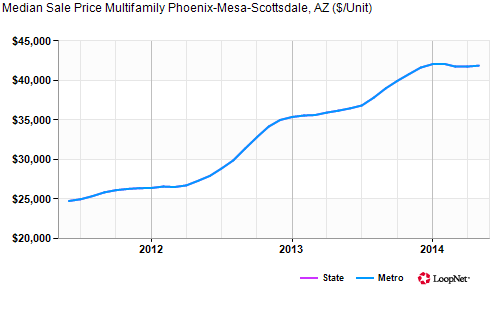

Because of strong fundamentals, Phoenix can also offer opportunity

to reposition or hold multi-family properties. Price per

unit has increased quickly since late 2011 and there is the opportunity to find value-plays with built-in profit.

Today most listed properties are over-priced and not good value.

I primarily search unlisted multi-family property opportunities

in Phoenix, although I occasionally find listed properties that

meet my high standards. Multi-family properties are not as

simple to list and sell by bank REO agents and these over-looked gems

are my favorite! I search for 4-plexes up to 40 units to

wholesale to my subscribed list on this website and 40-400 units to purchase myself with partners.