Johnson Frais

CEO/Founder

Johnson Frais has a passion

for real estate investing and helping others become financially free

through

passive income. He has studied real estate since 2000 and

began buying in Edmonton, Alberta with

partners in 2006.

Under his leadership,

PassionRight Properties has owned and managed rental properties since

2006 and

a fifteen unit condo complex since 2011. By cutting costs,

stabilizing revenue, and installing an on-site

caretaker, he was able to

bring the complex from the edge of bankruptcy to producing $2500/month

positive

cash flow. He has also increased the reserve fund

from zero to $30 000 without increasing condo fees or

collecting any owner

assessments. In the process, he took over

management of over half of the individual

units in the building,

changing the character of the complex through careful tenant screening.

Johnson leads large real estate investor education groups in Seattle,

Vancouver, and Edmonton. He

has been

teaching and practising multi-family acquisition since 2009 and self-storage facilities since 2010.

Johnson is experienced in short

sales, foreclosures, joint venture partnerships, and is

particularly skilled in

analyzing commercial income properties. His specialties are marketing, decreasing expenses, and working with a

team to increase profitability. Johnson has several years of experience hiring contractors and managing and designing

renovations. He recently acted as general contractor on a major rehab of his first rental property bought in 2006.

See full detailed pictures here: HOUSE REHAB

Since 2009, Johnson has successfully timed several real estate markets

and found exceptional investment

opportunities for his investors. In April of 2009, he lead a meeting in Vancouver where he presented Fort Myers,

Florida and the opportunity to buy wholesale rental properties with his

team. The median price had dropped from a

high of $285 000 in 2005 to a low of $75 000 at that time. The investors who acted have been well-rewarded, as

the median price has now reached $200 000, resulting in a return on investment of 166% solely through appreciation.

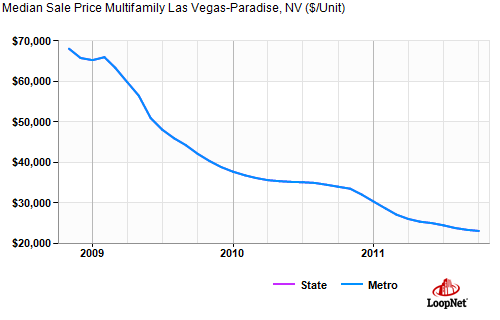

He then presented at a meeting in Edmonton in the spring of 2012 on

acquiring distressed multi-family. Showing graphs

of asking and

sales price/unit, multi-family supply, and other statistics, Johnson told the group that

he believed that the

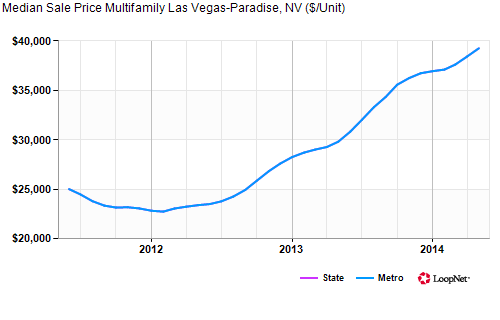

Las Vegas multi-family market was about to turn. Within a couple of months, graphs presented by

Loopnet began to show

the average sales price/unit for Las Vegas change

direction and start moving up! It has followed a steep incline in price/unit

since that time!

After reviewing hundreds of distressed multi-family and storage

facility deals in the southeastern U.S and Michigan in 2011,

Johnson

presented a deal to his groups in January of 2012. It was two newer, bank-owned

self-storage facilities in a growing

area of Michigan, for a total of

520 units. Acquisition price was $1 million or only $10/square foot!

Johnson explained his plan to lower expenses by changing the operation

of both facilities and to increase occupancy each

year through targeted marketing to local businesses in this quickly recovering

market. The properties are located near

Grand Rapids, Michigan.

After studying the local self-storage market and viewing competing

facilities, he stated that he

would be able to increase occupancy by 5% each year, resulting in large increases in cash flow and property value.

Johnson was successful in raising half of the $1 million required for

this purchase, but lost the acquisition of the property

to another

Michigan buyer in March of 2012. Johnson's projections and choice of this property as an excellent

investment was proven true this past December when the buyer was able to obtain a mortgage for $350 000 more

than their purchase price of just two years ago!

Here is the newsletter where Johnson had discussed this purchase:

NEWSLETTER

Johnson's goal is to create passive income through real estate, which

can allow him and his investors to spend more time

with family or following their other passions. Johnson's passions, reflected by

the name of his newsletter "Passion News",

include outdoor activities such as fishing and white-water canoeing, conserving the environment,

spending time with his

six siblings, parents, and twenty-five

nieces and nephews, and using his counseling skills from university to help

others

experience greater freedom in life. His dream is to own a

youth camp one day where troubled young people can experience

the outdoors and obtain long-term mentoring and guidance.