BUYING DISTRESSED INCOME PROPERTIES

January 2012

I have

studied and visited both properties as well as all competing facilities in the

area and have a solid plan to increase occupancy. The properties

are currently about 55% occupied and vacancy has decreased since the bank took

control. My office is located within two hours of these facilities and

I will manage them with one employee working on-site. I’m excited to take ownership of these

properties and start increasing occupancy by marketing to a specialized segment

of the local population.

The key to this deal (which makes it a secure investment) is

that even if I do nothing and they operate as they have the

last eight months (with little money spent on marketing by the bank), the properties will pay me back a good return. I am considering potential joint venture partners for this deal.

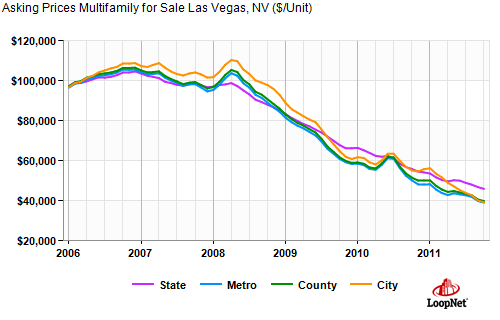

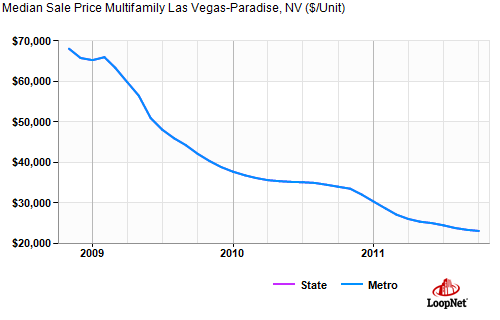

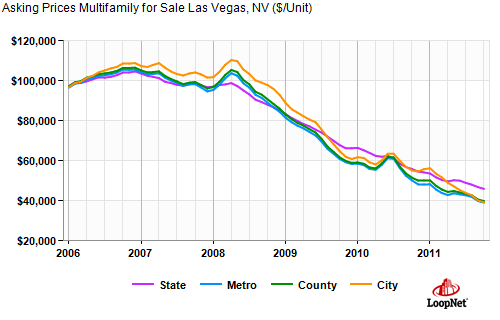

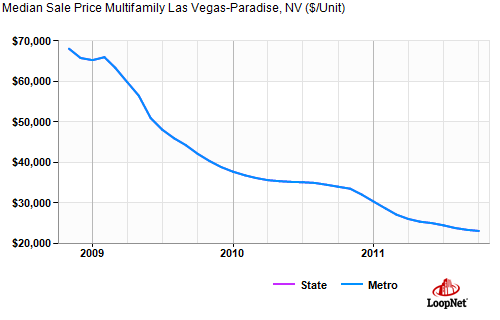

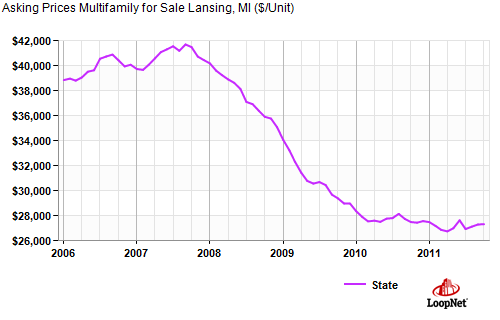

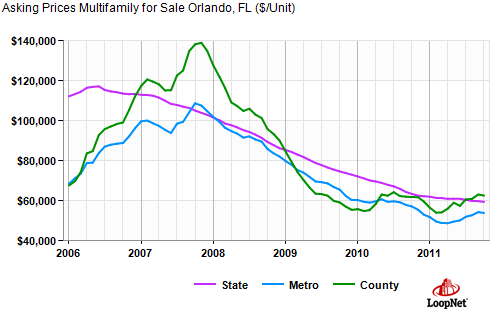

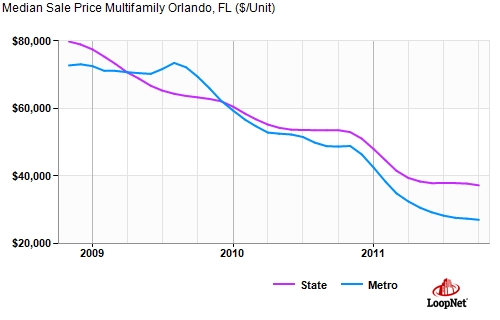

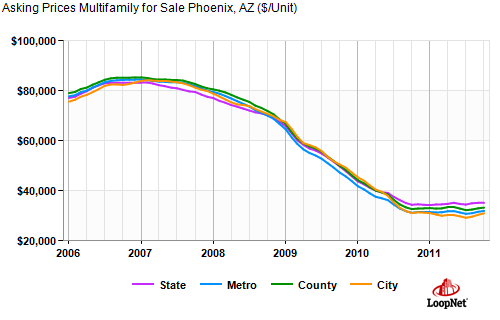

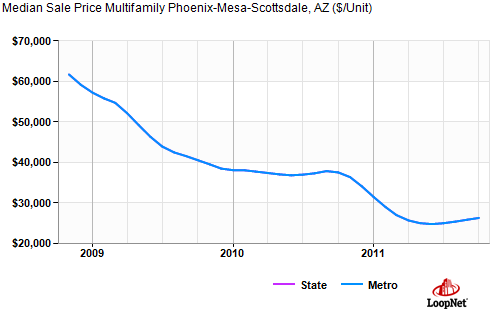

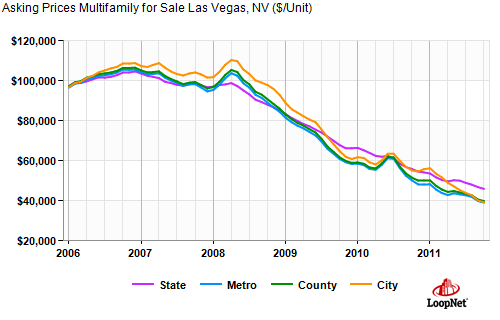

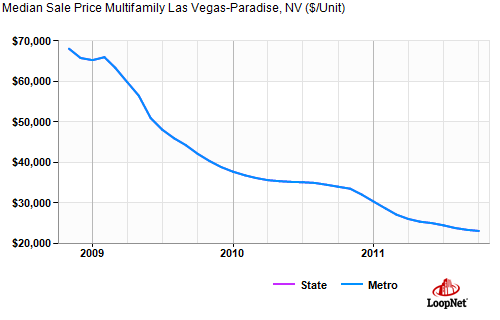

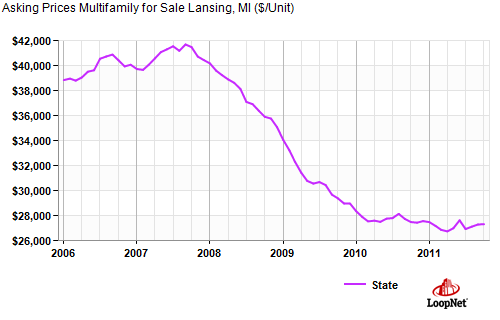

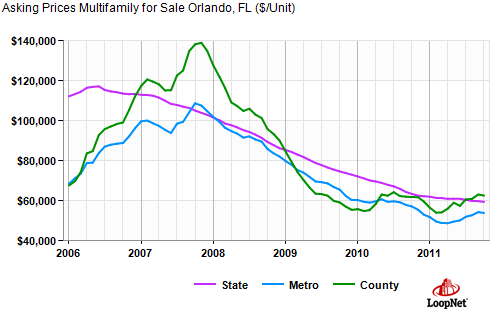

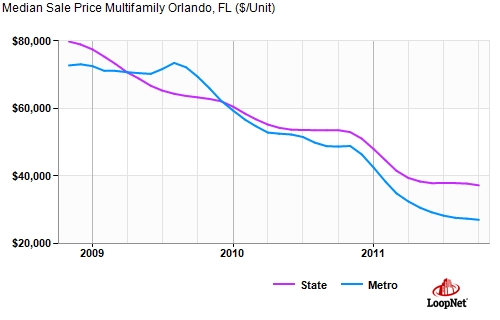

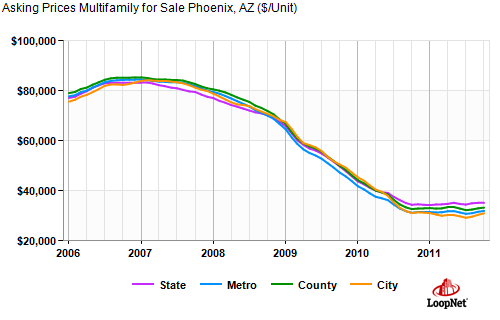

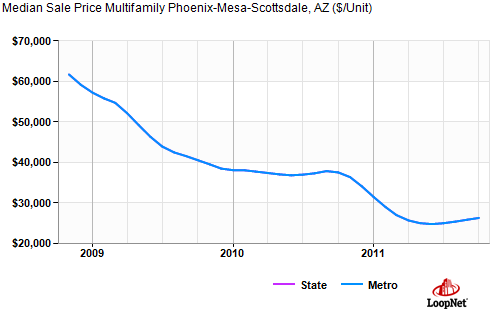

Commercial properties such as these do indeed

fluctuate in value according to the market cycle. In cities that have been hit hard by the

2008-2010 recession, commercial property values have decreased sharply and are

likely at their lowest point, as seen in the following graphs. In some cities, a slight recovery in prices

is evident.

As the

average price decreases, sales will typically increase and the number of

facilities available for sale will decrease.

That is the current situation in most U.S. cities. I expect a brief window of opportunity

remaining to buy quality properties at these incredible prices! My investment strategy is to buy select

distressed income properties at low prices over the next two years, improve the

financials of the property through professional property management, and enjoy

tax-advantaged cash flow for years to come.

With these particular storage facilities, I should be able to

refinance at

some point in the future, pull out my initial investment, and still

enjoy $185

000/year net cash flow.

Thank

you to those who have expressed interest in this particular deal. To learn more and discuss any available investment positions in my distressed storage and multi-family acquisitions, please enter your information below and someone will contact you to

answer any questions you may have:

Johnson Frais

PassionRight Properties

http://www.passionright.com

johnson@passionright.com

360-587-4464

780-628-2657